Barry Callebaut: Successfully navigated unprecedented market challenges, delivering on BC Next Level milestones Mittwoch, 06. November 2024 - 06:54

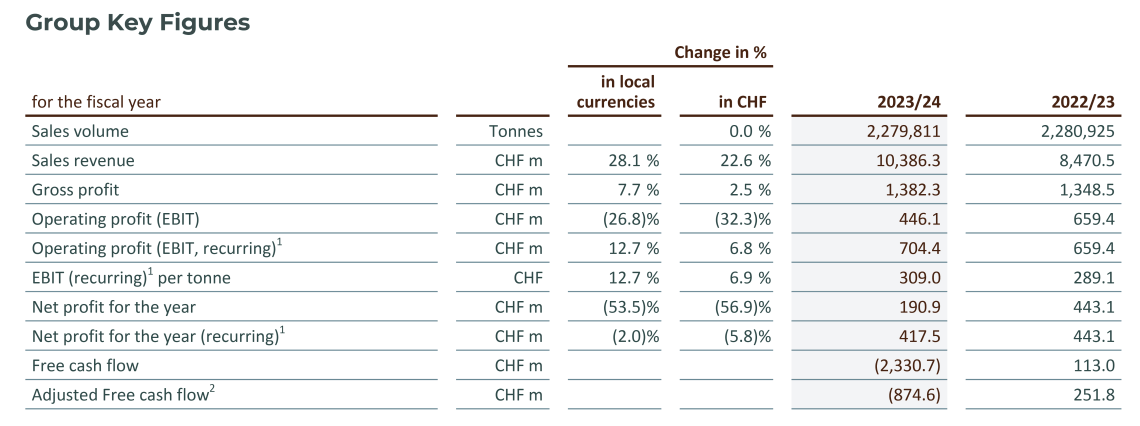

- Demonstrated resilience with slightly positive volume for Global Chocolate and flat volume for the Group in FY 23/24, despite significantly disrupted environment and new operational rigor to safeguard quality & food safety

- Sales revenue increased +28.1% in local currencies (+22.6% in CHF) to CHF 10.4 billion, driven by the acceleration in cocoa bean prices

- Operating profit (EBIT) recurring1 at CHF 704.4 million, up +12.7% in local currencies (+6.8% in CHF)

- Free cash flow of CHF -2,330.7 million as operational improvements were more than offset by the CHF 2,696.7 million increase in inventory value given significantly higher cocoa bean prices

- Major milestones achieved in first year of BC Next Level strategic investment program

- Proposed dividend of CHF 29.00 per share, in line with prior year

- Outlook for FY 24/25: flat volume in a challenging market, with slightly positive growth for Global Chocolate; double-digit EBIT recurring growth in constant currency

1 Refer to appendix (on page 10 of the PDF) for the detailed recurring results reconciliation.

2 Free cash flow adjusted for the cash flow impact of cocoa bean inventories regarded by the Group as readily marketable inventories (RMI).

The Barry Callebaut Group saw resilient sales volume of 2,279,811 tonnes (0.0% year-on-year) in fiscal year 2023/24 (ended August 31, 2024). Sales volume was down -1.2% in the fourth quarter, impacted by the phasing of customer purchases in Gourmet and decisive action to temporarily shut down the Toluca, Mexico facility proactively.

Global Chocolate saw +0.3% volume growth in fiscal year 2023/24, ahead of an overall declining chocolate confectionery market according to Nielsen (-1.1%)3..Volume development for Food Manufacturers (-1.5%) was impacted by soft demand from large global customers, partly offset by resilient performance for Private Label customers. Gourmet delivered +9.8% volume growth, with strong performance across geographies and market segments.

Looking at regional performance within Global Chocolate, Asia Pacific, Middle East and Africa (+5.2%) was the strongest contributor, with double-digit growth in the second half of the year supported by continued strong growth in India and improved performance in Indonesia. Volume in Western Europe (+0.8%) was solid as growth for Gourmet offset slower demand for Food Manufacturers. Latin America saw strong volume growth of +7.2% led by strong momentum in Brazil, particularly for Gourmet customers. Central and Eastern Europe (-1.2%) was impacted by lower volumes for several large global and regional customers. North America reported a volume decrease of -1.8%, driven by slower demand for large Food Manufacturers, while regional accounts and Gourmet saw continued momentum.

Global Cocoa saw a -1.4% decrease in sales volume, in the context of a significant increase in cocoa prices. Sales of cocoa butter and cocoa liquor were impacted by the supply constrained environment. Demand for cocoa powder remained robust, with particular strength in India and Indonesia.

Sales revenue increased +28.1% in local currencies (+22.6% in CHF), to CHF 10,386.3 million. The increase was driven by significant price increases to reflect the acceleration in cocoa bean prices, which Barry Callebaut manages through its cost-plus pricing model for the majority of its business.

Gross profit amounted to CHF 1,382.3 million, up +7.7% in local currencies (+2.5% in CHF), supported by the company's cost-plus pricing model and mix.

Operating profit (EBIT) recurring4 amounted to CHF 704.4 million, increasing by +12.7% in local currencies (+6.8% in CHF). The strong increase reflected the pass-through of higher financing costs through the cost-plus model, which are offset below the EBIT level, as well as mix and initial BC Next Level cost savings. During the year, quality costs increased with proactive action to ensure customer service in the case of incidents as well as tightened testing regimes and quality control. EBIT recurring4 for Global Chocolate was CHF 725.5 million, up +14.3% in local currencies (+7.6% in CHF), similarly reflecting the strength of the Group's cost-plus model. EBIT recurring4 for Global Cocoa was CHF 100.7 million, down -3.2% in local currencies (-6.0% in CHF). The decrease was a result of lower volumes in a supply constrained market as well as higher carry costs and futures rolling costs. The Corporate segment saw EBIT recurring4 of -121.8 million, down -7.9% in local currencies (0.3% in CHF). Recurring4 EBIT per tonne increased to CHF 309, up 12.7% in local currencies (+6.9% in CHF).

Operating profit (EBIT) reported amounted to CHF 446.1 million compared to CHF 659.4 million in the prior year, as a result of one-off BC Next Level operating expenses of CHF 264.5 million. Within this, CHF 171.4 million represent cash relevant non-recurring Next Level program and restructuring costs. Meanwhile, CHF 93.1 million of the one-off items were non-cash impairments and write-downs related to site closures.

Net profit recurring5 for the period amounted to CHF 417.5 million, down -2.0% in local currencies (-5.8% in CHF). Performance was impacted by the longer pricing cycle in the Gourmet business to fully pass-through accelerating costs, as well as higher quality costs. Net finance costs increased significantly to CHF -207.3 million, up from CHF -124.1 million in the prior year, mostly as a result of the higher debt level in the context of the cocoa bean price acceleration. On a recurring5 basis, income tax expense decreased to CHF 74.8 million from CHF 92.1 million in the prior-year period. This corresponds to an effective tax rate of 15.2% (prior-year period: 17.2%). The decrease in effective tax rate on a recurring basis mainly resulted from a somewhat more favorable mix of profit before taxes and the positive effect related to the Swiss Tax Reform that was introduced on January 1, 2020.

Net profit reported amounted to CHF 190.9 million, including one-off BC Next Level program expenses.

Net working capital increased to CHF 3,808.0 million, compared to CHF 1,466.2 million in the prior year. The increase was entirely due to the substantial negative impact from higher cocoa bean prices, given the long cycle between bean contracting and customer sales, as well as a significant increase in initial margins required by futures exchanges given the volatile environment.

Free cash flow declined to CHF -2,330.7 million, compared to CHF 113.0 million in the prior year. Operational improvements were driven by actions on planning and operational excellence, resulting in an improved cash conversion cycle. This was more than offset by the substantial cocoa bean price related working capital increase as well as BC Next Level program investments.

Net debt increased to CHF 3,818.0 million from CHF 1,308.7 million in the prior-year period. The increase is predominantly due to the CHF 2,696.7 million increase in inventory value due to the cocoa bean price acceleration.

3 Source: Nielsen volume growth excluding e-commerce – 26 countries, September 2023 to August 2024, data subject to adjustment to match Barry Callebaut’s reporting period. Nielsen data only partially reflects the out-of-home and impulse consumption.

4 Refer to appendix (on page 10 of PDF) for the detailed recurring results reconciliation.

5 Refer to appendix (on page 10 of PDF) for the detailed recurring results reconciliation.

Barry Callebaut’s BC Next Level strategic investment program is unlocking the company's full potential and leading position in the chocolate ingredients market by moving Barry Callebaut closer to markets and customers while fostering simplicity and digitalization.

Important progress has been achieved on BC Next Level initiatives in fiscal year 2023/24, keeping the implementation well on track. In order to step change standardization and digitalization, Barry Callebaut is centralizing enabling functions, with two additional Global Business Service (GBS) centers established in Monterrey (Mexico) and Hyderabad (India). The optimization of the Group's manufacturing network is well underway and closures have been completed for the factories in Norderstedt (Germany) and Port Klang (Malaysia). The intention to close the site in Intra (Italy) was announced in early September and the negotiations with the social partners are ongoing. Social plans have been completed in Germany (Norderstedt and Hamburg), France, Poland, the Netherlands and Port Klang (Malaysia). Significant progress has been made to simplify the portfolio, with around 25% of SKUs already phased out compared to the target of at least 30% reduction. BCOS, the new Barry Callebaut Operating System, was launched to standardize factory operations and connect processes globally, setting clear KPIs for all factories. Decisive action to safeguard quality and food safety has been taken, with a new operational rigor including the roll out of 100% positive product release and investments into plant infrastructure as well as testing capabilities. In the AMEA region, Barry Callebaut plans to launch a Center of Excellence for compound and Artificial Intelligence (AI) in Singapore to accelerate industry-wide innovation, with a particular focus on advancing compound chocolate applications and embracing digital transformation. Significant progress has been made on the implementation of end-to-end traceability and segregation, further strengthening the Group's leadership position in sustainability.

As previously announced, BC Next Level includes a strategic investment of net CHF 500 million in areas most relevant for customers and will in turn unlock CHF 250 million of cost savings, of which 75% are expected to flow-through to the bottom line.

Delivering on strategic long-term growth priorities

The BC Next Level program is fully unlocking the Group's leading position in the chocolate ingredients market in pursuit of four strategic growth priorities, which have already been contributing to performance in fiscal year 2023/24:

- Deepen outsourcing partnerships: During the fiscal year, the Group added around 35,000 tonnes of annualized volume through new outsourcing contracts and partnerships, including a major partnership with a new customer in North America and a significant ice cream customer in Europe.

- Gourmet 2.0:Gourmet delivered +9.8% volume growth in fiscal year 2023/24, with strong demand across geographies and market segments. The business regained market share and saw some benefits from initial strategic actions implemented to date.

- Scale up Specialties: During the year, the Group has taken important strategic steps to support its ambition to significantly accelerate its Specialties business. The Specialties business has been assessed and redefined to focus on a winning portfolio, which will further enable the company to be a trusted advisor to customers.

- Move to “fair" market share in the region AMEA (Asia Pacific, Middle East and Africa): The AMEA region reported +5.2% volume growth, with strong double-digit growth in India, Middle East and Africa. Within AMEA, the Gourmet business saw strong growth supported by continued expansion of the portfolio to new markets as well as enhancing the distribution network to ensure a segmented route-to-market. With increased investment on customer-facing resources, the region has been able to grow its customer base and tap into new customer segments.

In fiscal year 2024/25, Barry Callebaut expects to defend market share in a challenging market environment, with significant uncertainty on how cocoa-related price increases will impact short-term demand. In that context, Barry Callebaut expects flat volume, with slightly positive growth for Global Chocolate, and double-digit EBIT growth on a recurring basis in constant currency.

Barry Callebaut reconfirms that after the BC Next Level transition period, it expects to be on a long-term growth objective of Low Single-digit Plus to Mid Single-digit volume growth and Mid Single-digit Plus to High Single-digit EBIT growth starting from fiscal year 2025/26.

During the fiscal year 2023/24, terminal market6 prices for cocoa beans fluctuated between GBP 2,869 and GBP 9,835 per tonne and closed at GBP 5,332 per tonne on August 31, 2024. On average, cocoa bean prices increased by +131% versus the prior-year period. The period was marked by the materialization of a significant deficit for crop year 2023/24, and consequently low cocoa bean availability. This fundamental supply gap paired with persistently lower market participation (and resultantly low liquidity) led to significant volatility and intraday price fluctuations.

The world market price of sugar was on average +4% higher than in the prior-year period, given lower sugar production in two major exporting countries, India and Thailand. This was due to El Niño's impact on sugarcane development during 2023. In Europe, sugar prices were on average -32% lower due to sugar beet acreage gains announced for the 2024/25 campaign, higher domestic supply coupled with the strong pace of Ukrainian exports in 2023/24, and lower energy prices.

Dairy prices decreased on average by -10% compared to the prior year, given the high inflationary environment last year. However, over the course of the fiscal period, dairy prices rose steadily as milk supply struggled in most major exporting regions, and demand was stable at elevated levels.

6 Source: London terminal market prices for 2nd position, September 2023 to August 2024. Terminal market prices exclude Living Income Differential (LID) and country differentials.

Payout to shareholders

The Board of Directors is proposing to shareholders at the virtual Annual General Meeting of Shareholders (vAGM) on December 4, 2024, a payout of CHF 29.00 per share. This is consistent with the Group's previous communication that during the BC Next Level transition period, the dividend per share will not be lower than in fiscal year 2022/23. The dividend will be paid to shareholders on, or around, January 9, 2025, subject to approval by the Annual General Meeting of Shareholders.

Board of Directors

Antoine de Saint-Affrique, Board member since 2021, Tim E. Minges, Board member since 2013, and Yen Yen Tan, Board member since 2020, will not be standing for re-election at the Annual General Meeting of Shareholders on December 4, 2024. The Board of Directors would like to express its sincere gratitude to Antoine de Saint-Affrique, Tim E. Minges, and Yen Yen Tan for their valuable contributions to the Board.

All other members of the Board will stand for re-election for another term of office of one year.

The Board of Directors proposes to elect Barbara Richmond, British national, and Aruna Jayanthi, Indian national, as new members of the Board.

Barbara Richmond brings a wealth of financial and strategic expertise, which she gained in her career as CFO of several companies. She currently serves as CFO of Redrow, a major UK home construction company, and as Group Integration and Synergies Director of Barratt Redrow. Barbara Richmond has extensive Board experience, including her role on the Board of Lonza Group, a global leader in healthcare manufacturing from Switzerland, where she also chairs the Audit and Compliance Committee.

Aruna Jayanthi is an experienced leader from the global consulting industry, having held several management positions at Capgemini, including CEO of India, CEO of Asia Pacific and Latin America, and her current role leading Capgemini's business in Canada and Latin America. She is a member of the Capgemini Group’s Executive Committee. Aruna Jayanthi has also been an Independent Member of the Supervisory Board of Michelin Group, where she additionally serves on the Audit Committee.

Further information is available in the following publications:

Annual Report 2023/24 (English; PDF)

Annual Social and Environmental Impact Report 2023/24 (English; PDF)

Report on non-financial matters pursuant to art. 964a et seq. of Swiss Code of Obligations 2023/24 (English; PDF)

Available at the following link on the Barry Callebaut website: www.barry-callebaut.com/en/about-us/investors/results-presentations

| Date: | Wednesday, November 6, 2024, at 10:30 – 12:00 CET |

| Location: | SIX Convention Point, Pfingstweidstrasse 110, 8005 Zurich |

This will be a physical conference for analysts and investors, hosted by Peter Feld, CEO, and Peter Vanneste, CFO, which can also be followed via telephone or webcast. Dial-in and access details can be found here.

Financial Calendar for Fiscal Year 2024/25(September 1, 2024 to August 31, 2025)

| Annual General Meeting 2023/24 | December 4, 2025 |

| 3-Month key sales figures 2024/25 | January 22, 2025 |

| Half-Year Results 2024/25 | April 10, 2025 |

| 9-Month Key Sales Figures 2024/25 | July 10, 2025 |

| Full-Year Results 2024/25 | November 5, 2025 |

| Annual General Meeting 2024/25 | December 10, 2025 |

- Press Release English

- Press Release German

- Annual Report 2023-24

- Report on non-financial matters according to Swiss Code 2023-24

- Annual Social & Environmental Impact Report 2023-24

7 Please refer to appendix (on page 10 of PDF) for the detailed recurring results reconciliation.

8 Prior-year figures are restated, please refer to Note 1 of the Annual Report 2023/24 (on page 34 of PDF) for details.

9 Non-IFRS measures are defined under the Alternative Performance Measures in the Annual Report 2023/24 on page 148.

10 Please refer to appendix (on page 10 of the PDF) for the detailed recurring results reconciliation.

11 Adjusted for the impact of cocoa bean inventories regarded by the Group as readily marketable inventories (RMI).

12 Reported mainly as "Other income" (CHF 5.8 million) and excluding interest income of CHF 4.9 million which is reported as "Finance income".

13 BC Next Level cost include CHF 199.3 million reported as "Other expense" (refer to Note 1.3 - "Other income and expense" in the Annual Report 2023/24),

CHF 61.0 million program cost reported as "General and administration expenses" and CHF 4.2 million of write-down of inventories reported as "Cost of goods sold".

About Barry Callebaut Group:

With annual sales of about CHF 10.5 billion in fiscal year 2023/24, the Zurich-based Barry Callebaut Group is the world’s leading manufacturer of chocolate and cocoa products – from sourcing and processing cocoa beans to producing the finest chocolates, including chocolate fillings, decorations and compounds. The Group runs more than 60 production facilities worldwide and employs a diverse and dedicated global workforce of more than 13,000 people. The Barry Callebaut Group serves the entire food industry, from industrial food manufacturers to artisanal and professional users of chocolate, such as chocolatiers, pastry chefs, bakers, hotels, restaurants or caterers. The global brands catering to the specific needs of these Gourmet customers are Callebaut® and Cacao Barry®, Carma® and the decorations specialist Mona Lisa®. The Barry Callebaut Group is committed to make sustainable chocolate the norm to help ensure future supplies of cocoa and improve farmer livelihoods. It supports the Cocoa Horizons Foundation in its goal to shape a sustainable cocoa and chocolate future.

Kai Hummel

Global of Head of Communications

Barry Callebaut AG

+41 43 204 15 22

media@barry-callebaut.com

Sophie Lang

Head of Investor Relations

Barry Callebaut AG

+41 79 275 83 95

investorrelations@barry-callebaut.com